Pre tax profit margin formula

Pre-Tax Profit Margin is then calculated as. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit.

Pre Tax Profit Margin Formula And Ratio Calculator

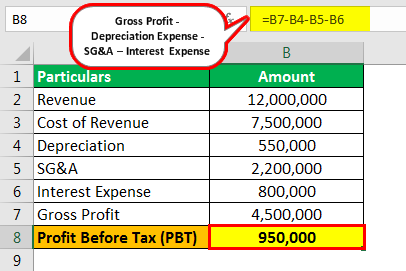

Subtract depreciation SGA expenses and interest expense further to obtain profit before tax.

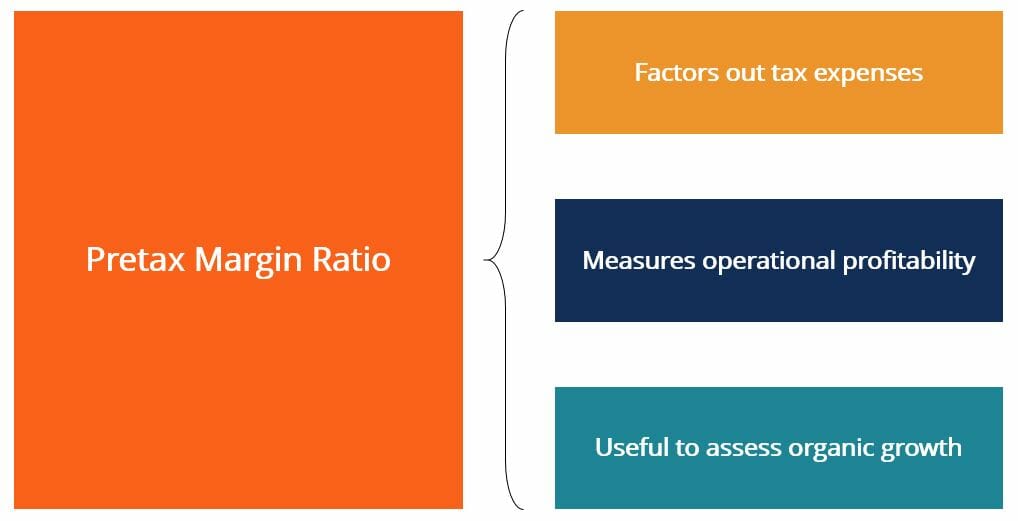

. Contrary to EBIT the PBT method accounts for the interest expense. Still as a general rule a 10 net profit margin is considered average a 20 margin is considered high or goo and a 5. The pretax profit margin is calculated by the formula.

A companys after-tax profit margin is important because it tells. Gross Profit 4500000. Calculating Net Profit Margin.

Rates subject to change. EBT ratio 100 EBT R EBT ratio 100 E B T R. We calculate it by dividing profit before tax pretax profit divided by revenue.

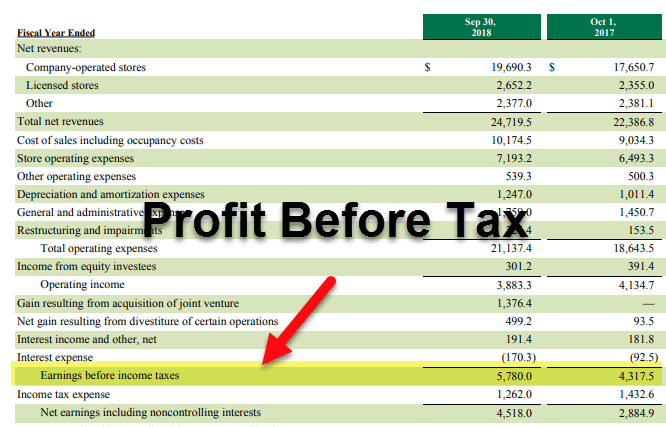

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Its computed by getting the total sales revenue and then subtracting the cost of goods sold operating. After-tax profit margin is a financial performance ratio calculated by dividing net profit after taxes by revenue.

Profit Margin Profit Metric Revenue Typically profit margins are denoted in percentage form so the figure is then multiplied by 100. Pretax profit margin is also called pretax margin pretax income margin earning before tax. In other words you take the gross revenue subtract all expenses down to.

The last profit margin calculation is net Profit. The formula for Pre-Tax Profit is as follows. Using the proper formula our hypothetical companys pre-tax profit margin comes out to be 25.

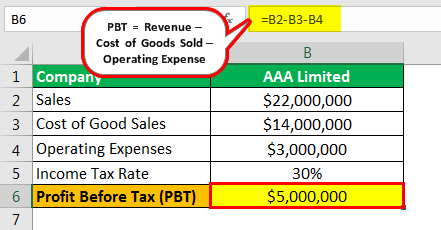

About 1460000000 search results. It deducts depreciation amortization and includes other income loss. Therefore the calculation of PBT as per the formula.

50000 30000 20000. Revenue 200 million. Income Before Taxes divided by Revenue multiplied by 100.

Margin rates as low as 283. The pretax profit margin formula. Pre-tax profit is a variation of operating profit.

Pre-Tax Profit Margin Earnings Before Tax. A good margin can vary considerably by industry. Pre-Tax Margin 50 million 200 million 250.

Pre-Tax Income 30. Pre -tax profit is a companys operating profit after interest on debt has been paid plus any unusual items -- but before taxes are paid. A good margin will vary considerably by industry and size of business but as a general rule of thumb a 10 net profit margin is considered.

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Margin Ratio Learn How To Calculate And Use The Pmr

Net Profit Margin Macrotrends

Pretax Profit Margin Formula Meaning Example And Interpretation

Pretax Income Definition Formula And Example Significance

Pretax Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Profit Margin Formula Meaning Example And Interpretation

Pretax Profit Margin Formula Meaning Example And Interpretation

Pretax Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Profit Margin Formula And Ratio Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

Pre Tax Profit Margin Formula And Ratio Calculator

Pretax Margin Prepnuggets

Net Profit Margin Formula And Ratio Calculator

Profit Before Tax Formula Examples How To Calculate Pbt